BltLW News Hub

Your source for the latest insights and updates.

Discounts on Wheels: How to Keep Your Premiums in the Fast Lane

Rev up your savings with tips on keeping insurance premiums low while enjoying the ride. Discover discounts on wheels today!

5 Effective Strategies to Lower Your Auto Insurance Premiums

Lowering your auto insurance premiums can significantly impact your overall budget. Here are five effective strategies that can help you achieve this goal:

- Shop Around: Don't settle for the first quote you receive. Take the time to compare rates from different insurers, as premiums can vary widely.

- Increase Your Deductible: A higher deductible usually means lower premiums. However, ensure that you can afford to pay the deductible in case of an accident.

- Take Advantage of Discounts: Many insurance companies offer discounts for safe driving, multiple policies, and even good grades for students. Check with your provider to see what discounts you qualify for.

An additional strategy is to maintain a good credit score, as insurers often consider credit history when determining rates. Furthermore, consider reducing unnecessary coverage on older vehicles that may not be worth the premium cost. By implementing these strategies, you can effectively manage your auto insurance expenses while ensuring you have adequate coverage.

Understanding Discounts: How to Qualify for Cheaper Car Insurance

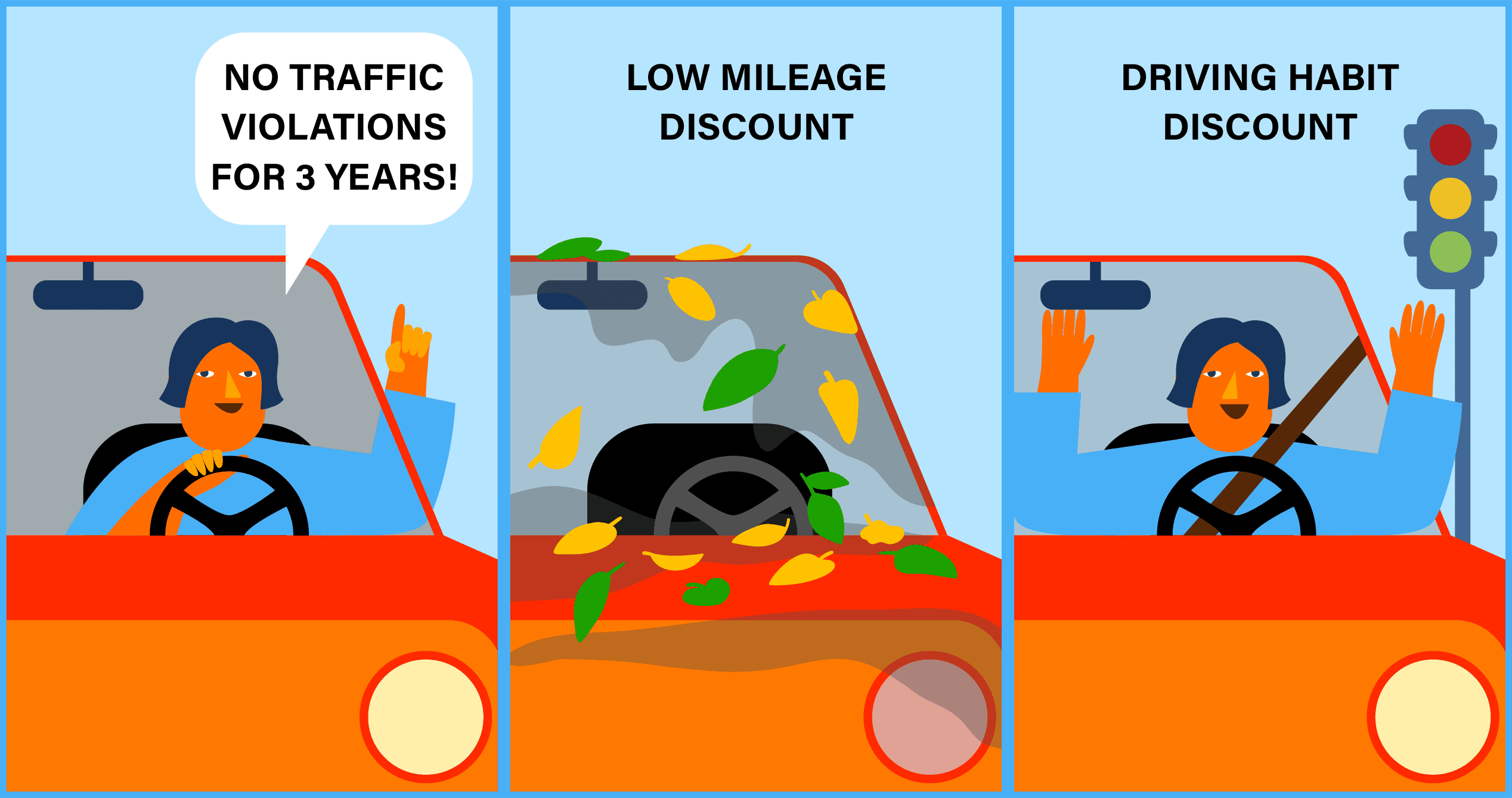

Understanding discounts is essential for anyone looking to save on car insurance premiums. Numerous factors can qualify you for cheaper car insurance, and it's crucial to be aware of these when comparing policies. Common discounts include safe driver discounts, which reward drivers with clean driving records, and multi-policy discounts for those who bundle their auto insurance with other types, such as home or renters insurance. Additionally, many insurers offer discounts for low mileage, good student performance, and safety features installed in your vehicle.

To take full advantage of available discounts, it’s important to communicate openly with your insurance agent. Ask about all possible discounts and provide any necessary documentation to qualify. Other strategies include enrolling in defensive driving courses, which can also lead to significant savings. By understanding and utilizing these discounts, you can effectively lower your car insurance costs and ensure you are getting the best coverage for your needs.

Is Your Driving Habits Driving Up Your Premiums?

Your driving habits can significantly impact your car insurance premiums. Insurers analyze various factors, including your driving record, mileage, and even the times you typically drive. For example, if you frequently drive during rush hour or in high-traffic areas, you might be more prone to accidents, leading to higher premiums. Additionally, consistent speeding or aggressive driving can raise red flags for insurers, suggesting a greater risk. Driving habits that include safe practices, such as obeying speed limits and minimizing distractions, generally lead to more favorable insurance rates.

Moreover, adopting better driving habits can not only lower your premium but also improve your overall safety on the road. Consider implementing techniques such as defensive driving, utilizing cruise control on highways, and maintaining a safe following distance. Many insurance providers even offer discounts for drivers who take defensive driving courses or maintain a clean driving record over time. By being proactive about your driving habits, you can take control of your insurance costs while ensuring a safer driving experience for yourself and others.