BltLW News Hub

Your source for the latest insights and updates.

Term Life Insurance: A Safety Net You Didn't Know You Needed

Discover how term life insurance can be the essential safety net you never knew you needed. Protect your loved ones today!

Understanding the Benefits of Term Life Insurance: Is It Right for You?

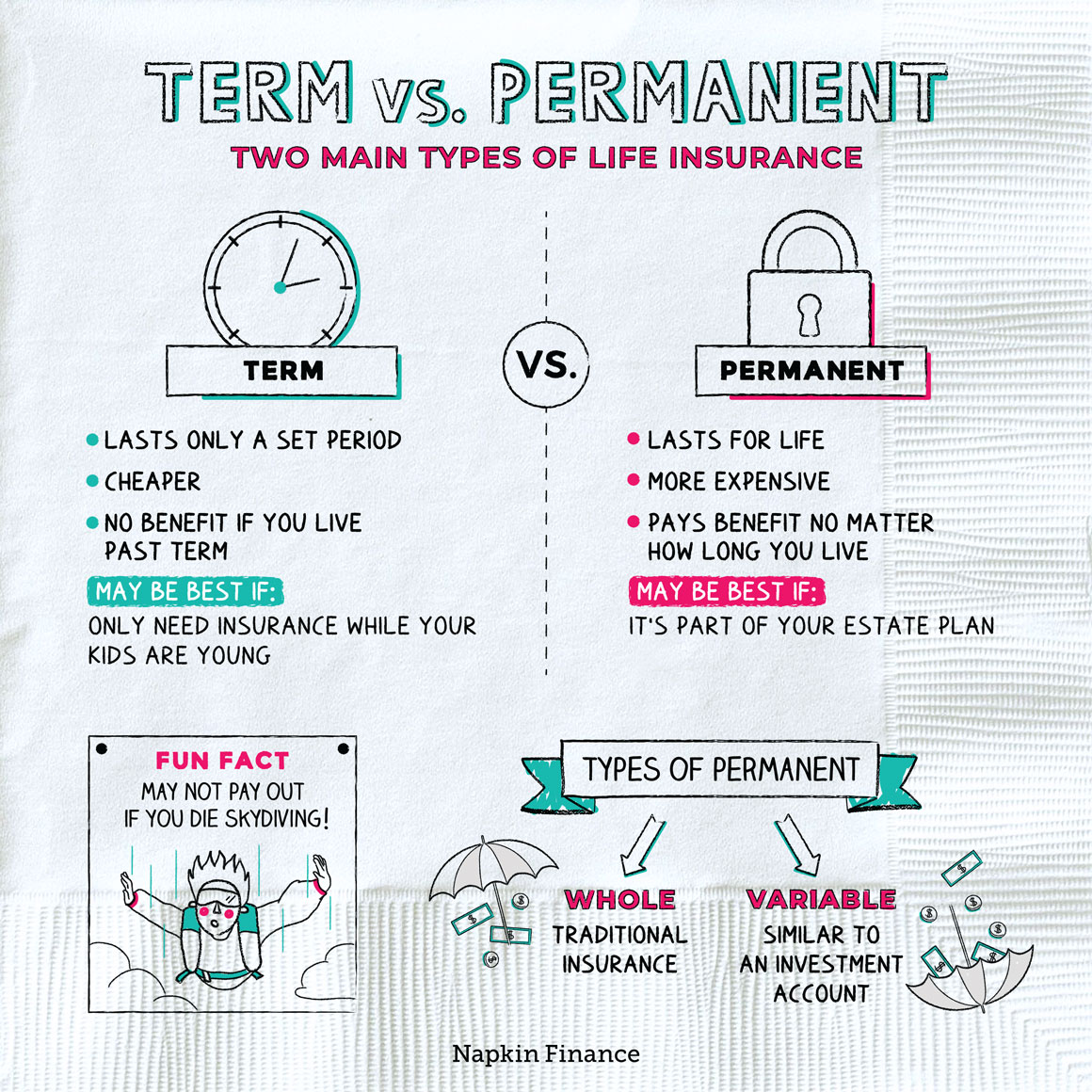

Term life insurance is a straightforward and affordable way to protect your loved ones financially in the event of your untimely death. Unlike permanent life insurance, which provides coverage for your entire life and often includes a cash value component, term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years. This makes it a compelling choice for individuals looking for cost-effective solutions to cover temporary financial responsibilities such as mortgage payments or education expenses. Additionally, many term policies allow for conversion to permanent insurance, providing flexibility as your needs change over time.

One of the main benefits of term life insurance is its affordability compared to other types of life insurance. Since it only provides coverage for a specific term, premiums are generally lower, making it accessible for young families and individuals who may be on a budget. By comparing quotes and policies from various insurance providers, you can find a plan that meets your needs without breaking the bank. Ultimately, understanding your personal financial situation and future obligations will help you determine if term life insurance is the right choice for you.

How Term Life Insurance Can Protect Your Family's Financial Future

Term life insurance serves as a vital financial safety net for families, providing peace of mind by ensuring that loved ones are protected in the event of a tragedy. It offers coverage for a specified period, usually ranging from 10 to 30 years, during which beneficiaries will receive a death benefit if the insured passes away. This can be crucial in covering significant expenses such as mortgage payments, children's education, and daily living costs. The affordability of term life insurance makes it accessible for families who want to secure their financial future without breaking the bank.

Moreover, term life insurance is straightforward to understand and manage. Policyholders can easily compare different plans and choose one that best fits their family's needs. Many policies also allow for the conversion to permanent insurance down the line, adding flexibility to one's financial strategy. By investing in term life insurance, families can ensure that they are not left in a financial bind should the unexpected happen. To learn more about the benefits and how it can serve your family better, visit NerdWallet.

What You Need to Know About Term Life Insurance Policies and Coverage

Term life insurance is one of the most common types of life insurance policies available today. It provides coverage for a specified period, usually ranging from 10 to 30 years, and pays a death benefit to the designated beneficiaries if the insured passes away during that term. This type of insurance is often favored because it offers a more affordable premium compared to permanent life insurance policies, making it accessible for a wide range of individuals. Before purchasing, it is essential to assess your financial obligations and long-term goals, taking into consideration factors such as dependents, debts, and any future expenses. For detailed guidance on choosing the right term, visit NerdWallet.

When selecting a term life insurance policy, be sure to evaluate key features such as convertibility, renewability, and premium costs. Many policies offer the option to convert to a permanent policy as your needs change. Additionally, consider any exclusions that may apply, such as suicide clauses within the first two years of coverage. Regularly reviewing your policy alongside your financial situation is crucial to ensure that your coverage remains adequate. For an in-depth analysis on understanding policy terms, check out Policygenius.