BltLW News Hub

Your source for the latest insights and updates.

Save Big with These Sneaky Auto Insurance Discounts

Unlock hidden auto insurance savings! Discover sneaky discounts you didn't know existed and start saving big today!

Unlock Hidden Savings: A Guide to Auto Insurance Discounts

Auto insurance can be a significant expense for many drivers, but there are numerous discounts available that can help you save money. Understanding these hidden savings opportunities is crucial for minimizing your insurance costs. Common discounts include multi-policy discounts for bundling auto and home insurance, good student discounts for young drivers who maintain a certain GPA, and low mileage discounts for those who drive less frequently. Each insurance provider has different criteria for these discounts, so it’s essential to shop around and compare policies.

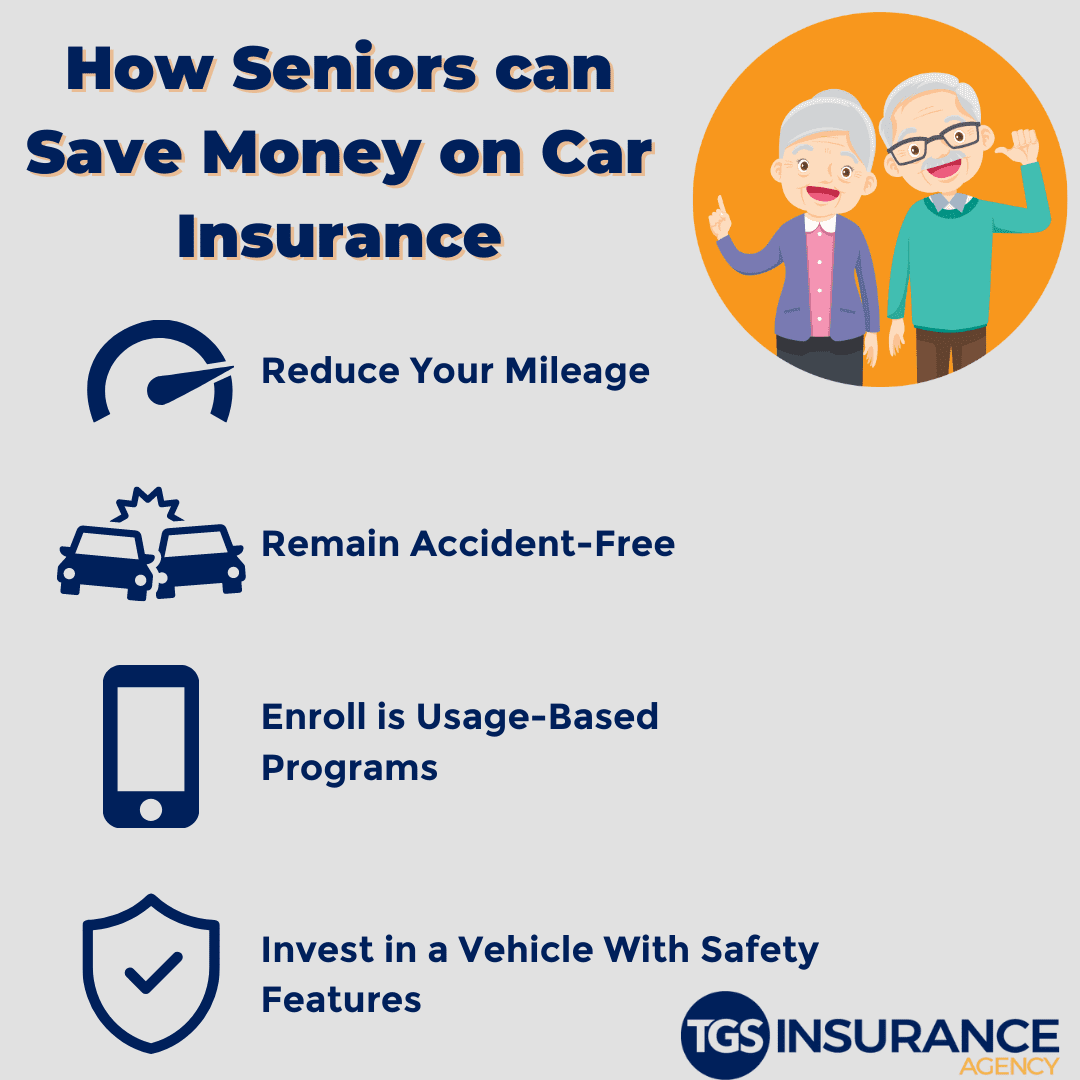

In addition to the standard discounts, you might qualify for lesser-known savings, such as defensive driving discounts for completing a certified driving course or retirement discounts for being a senior or retired individual. Don't underestimate the potential savings from these options. Always communicate with your insurance agent and ask about all available discounts. This proactive approach can unlock significant savings and help you find the best rate for your auto insurance needs.

Are You Missing Out? Discover Common Auto Insurance Discounts

Many drivers are unaware of the various auto insurance discounts available to them, which can significantly reduce their premiums. From safe driving records to bundling policies, these discounts come in various forms. For instance, if you maintain a clean driving history with no accidents or violations, you may qualify for a safe driver discount. Additionally, insurers often provide discounts to those who bundle their auto insurance with other types of coverage, such as home or renters insurance.

Another common set of auto insurance discounts is based on your vehicle's features and your usage patterns. Many providers offer discounts for cars equipped with safety features like anti-lock brakes, airbags, and adaptive cruise control. Moreover, driving fewer miles annually can also lead to significant savings, as low-mileage drivers are often seen as lower risk. Don't miss out on these potential savings—talk to your insurance agent today to explore all the discounts you might qualify for!

10 Sneaky Ways to Save on Your Auto Insurance Premium

Many drivers feel the pinch when it comes to their auto insurance premiums. However, there are several sneaky ways to save that can significantly lower your costs. Consider bundling your insurance policies: many providers offer discounts when you combine auto insurance with home or renters insurance. Additionally, reviewing your coverage annually can help identify areas where you might be over-insured. Always ensure your deductibles are set to levels that make sense for your financial situation.

Another effective strategy is to take advantage of driver discounts. Many insurance companies offer reductions for safe driving records or completing defensive driving courses. Furthermore, don’t forget to inquire about discounts related to your vehicle's safety features. Lastly, maintaining a good credit score can lead to lower premiums, as insurance companies often consider your credit history when calculating rates.