BltLW News Hub

Your source for the latest insights and updates.

Insurance Policies That Won't Leave You in a Lurch

Discover insurance policies that truly have your back! Uncover options that protect you without the hassle. Don't get left behind!

Understanding the Basics: What You Need to Know About Reliable Insurance Policies

Understanding the basics of reliable insurance policies is essential for safeguarding your financial future. These policies provide coverage against various risks, and it is crucial to evaluate them thoroughly to ensure they meet your needs. Start by assessing the types of insurance available, such as health, auto, home, and life insurance. Each type serves a unique purpose, and knowing which ones are necessary for your situation will help you make informed decisions.

When considering reliable insurance policies, pay attention to key factors such as premiums, deductibles, and coverage limits. A good practice is to compare different quotes and look for customer reviews to gauge the insurer's reputation. Also, take the time to read the policy terms carefully to understand what is and isn't covered. Being proactive in your research will ensure that you choose an insurance policy that not only fits your budget but also provides the protection you need.

Top 5 Insurance Policies That Offer Comprehensive Coverage and Peace of Mind

When it comes to safeguarding your financial future, choosing the right insurance policy is crucial. Here are the Top 5 Insurance Policies that offer Comprehensive Coverage and the peace of mind you deserve:

- Health Insurance: A solid health insurance plan covers a wide range of medical expenses, ensuring that you receive the care you need without the burden of prohibitive costs.

- Homeowners Insurance: This policy not only protects your home from damage and theft but also provides liability coverage, giving you peace of mind for accidents that may occur on your property.

- Auto Insurance: Comprehensive auto insurance includes liability, collision, and uninsured motorist coverage, ensuring that you stay protected on the road from unforeseen incidents.

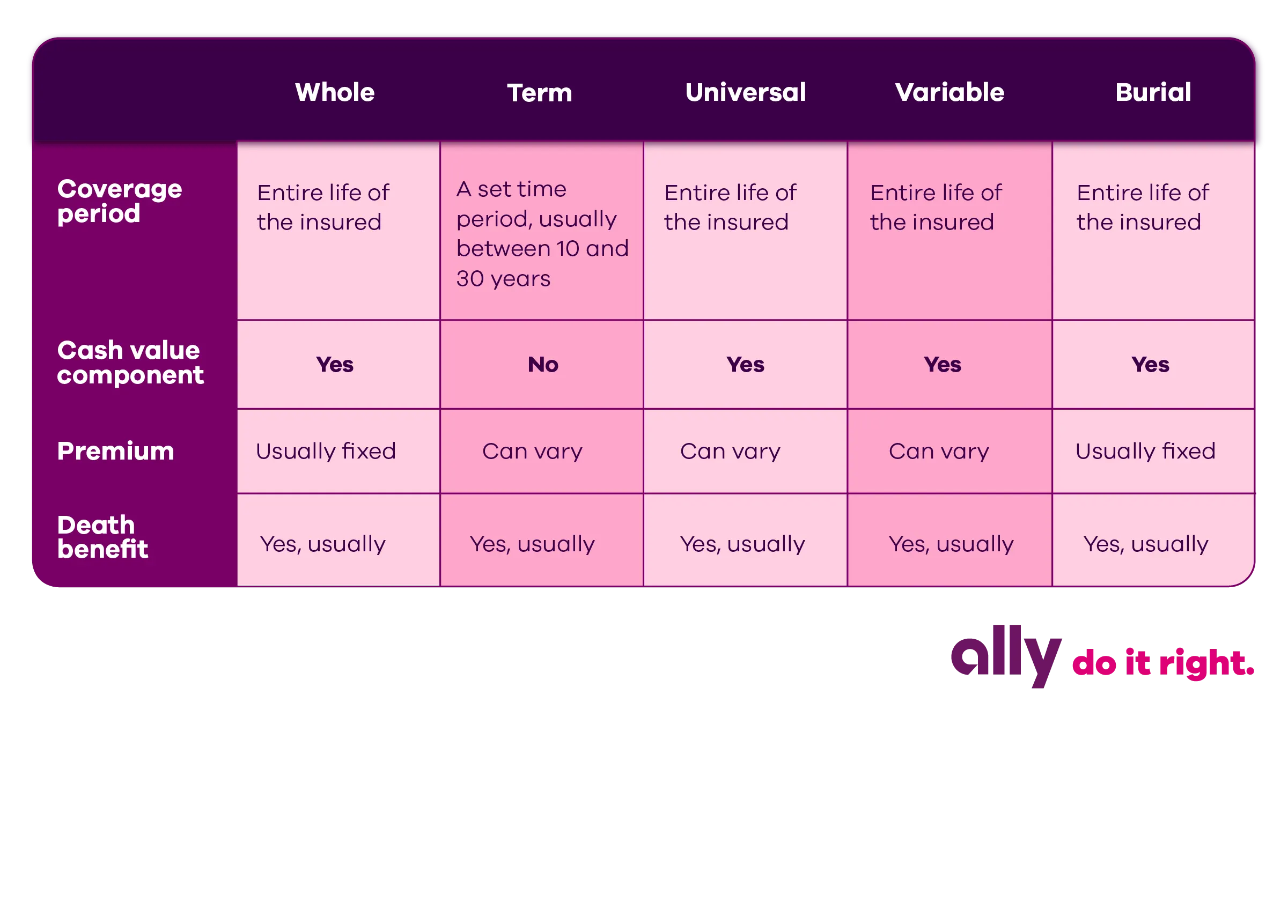

- Life Insurance: Having a life insurance policy ensures that your loved ones are financially secure in the event of your untimely passing, offering them a safety net during a difficult time.

- Disability Insurance: This policy provides income replacement if you are unable to work due to a disability, allowing you to maintain your financial stability.

Are You Protected? Key Questions to Ask Before Choosing an Insurance Policy

Choosing the right insurance policy can feel overwhelming, but understanding your needs is essential in ensuring you are adequately protected. Start by asking yourself: What type of coverage do I need? Depending on your circumstances, you might require health, auto, home, or life insurance. It’s crucial to assess your lifestyle and financial situation to determine the right policy for you. Do I understand the policy terms? Read the policy details carefully; clarity on terms can prevent future disputes and ensure you know what exactly is covered.

Next, consider the financial stability of the insurance provider. Look for companies with a strong reputation for paying claims and providing customer service. Ask yourself, What is my budget? While it’s important to find affordable coverage, be wary of policies that seem too cheap; they might offer inadequate protection. Finally, inquire about available discounts and customization options for your policy. By asking these key questions, you can make an informed decision that truly protects what matters most to you.